Options

Intuitive tools with great service and value

- Among the lowest options contract fees in the market

- Easy-to-use platform and app for trading options on stocks, indexes, and futures

- Support from knowledgeable Options Specialists

- Close short options positions priced at 10¢ or less with no contract fee

when you place 30+ stock

per contract

Get up. Deposit now €250 to start trading

Open and fund a new brokerage account with a qualifying deposit.

Award winning options trading tools

Whether you’re in-the-money, or out-of-the-money, we’ll help you keep on top of your money with intuitive tools for trading options on stocks, indexes, and futures.

-

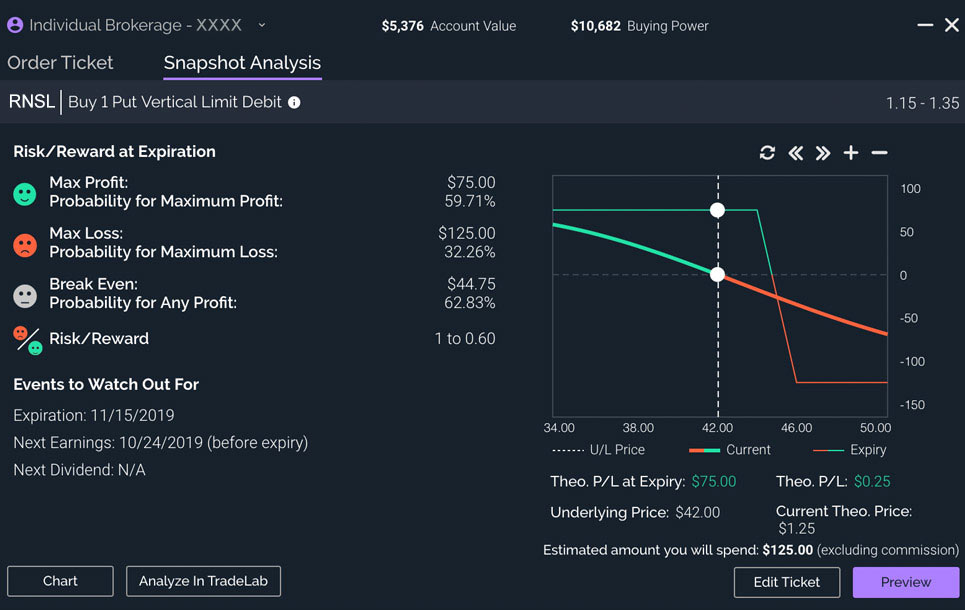

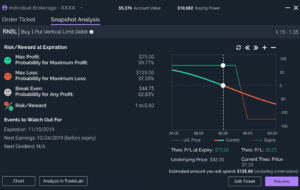

Risk / Reward Probabilities

-

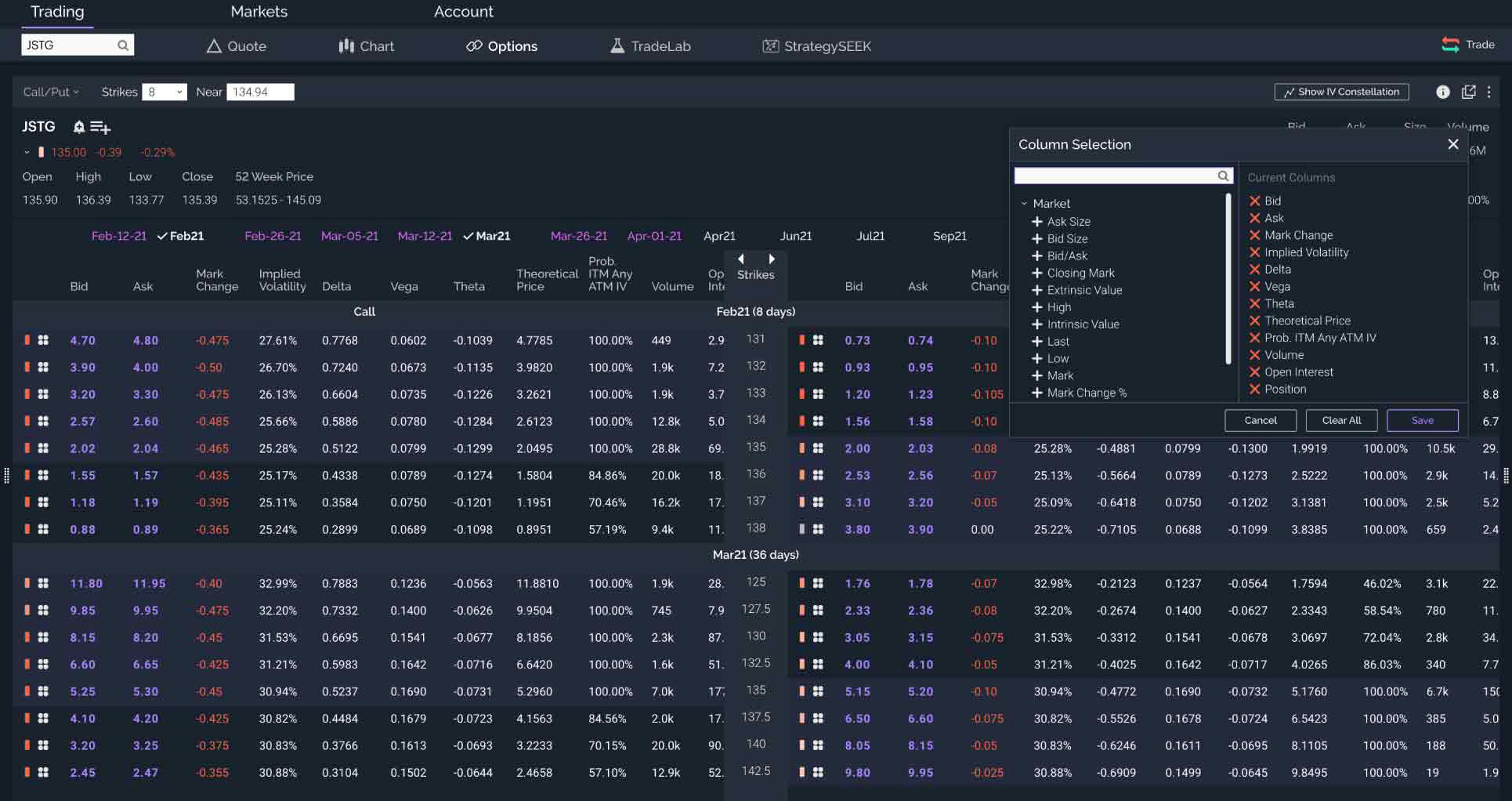

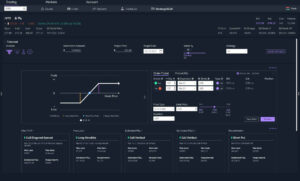

Customizable Option Chain

-

Earnings Move Analyzer

-

Preset Scans

-

Spectral Analysis

-

Strategy Seek

-

Risk Slide

Dime Buyback Program

Pay no per-contract charge when you buy to close an equity option priced at 10¢ or less. This allows you to close short options positions that may have risk, but currently offer little or no reward potential—without paying any contract fees.5

Discover options on futures

Options on futures offer nearly 24-hour access6 to react around potentially market moving economic events. Hedge existing futures positions, earn premium or speculate while using less money upfront. Plus, diversify into metals, energies, currencies and more.

Options Pricing

Pricing | Preferred 30+ Trades / QTR | Standard <30 Trades / QTR |

|---|---|---|

| Equity and Index Options | €0.50 per contract €0 base | €0.65 per contract €0 base |

| Futures Options | €1.50 per contract | €1.50 per contract |

Options Levels

Add options trading to an existing brokerage account.

| Level 1 | Level 2 | Level 3 | Level 4 | |

|---|---|---|---|---|

| Option Investment Objective | Income, Aggressive Income, Capital Appreciation, Speculation | Aggressive Income, Capital Appreciation, Speculation | Capital Appreciation or Speculation | Speculation |

| Options strategies available | Covered positions

| All Level 1 strategies, plus:

| All Level 1 and 2 strategies, plus:

| All Level 1, 2, and 3 strategies, plus:

|

*Margin approval is required for Levels 3 and 4.

Important note:

Options involve risk and are not suitable for all investors. For more information, please read the Characteristics and Risks of Standardized Options before you begin trading options. Also, there are specific risks associated with covered call writing, including the risk that the underlying stock could be sold at the exercise price when the current market value is greater than the exercise price the call writer will receive. A covered call writer forgoes participation in any increase in the stock price above the call exercise price and continues to bear the downside risk of stock ownership if the stock price decreases more than the premium received. Because of the importance of tax considerations to all options transactions, the investor considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. Commissions and other costs may be a significant factor. An options investor may lose the entire amount of their investment in a relatively short period of time.

Learn more about options

Our knowledge section has info to get you up to speed and keep you there.